Angel Oak Capital Advisors senior market strategist Frank Ros discusses the impact of geopolitical uncertainty on markets after Israel’s attack on Iran.

Investors flocked to safer assets, including gold and out of U.S. stocks, after Israel launched attacks against Iran’s nuclear sites.

All three of the major U.S. averages fell Friday, erasing weekly gains, with the Dow Jones Industrial Average down 769 points, or 1.8%, while the Nasdaq Composite and S&P 500 lost over 1% apiece.

Selling accelerated late afternoon on reports Iran retaliated, launching ballistic missiles at Israel, according to Fox News.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 42197.79 | -769.83 | -1.79% |

| SP500 | S&P 500 | 5976.97 | -68.29 | -1.13% |

| I:COMP | NASDAQ COMPOSITE INDEX | 19406.826064 | -255.66 | -1.30% |

Despite the Friday sell-off, the S&P 500, the broadest measure of U.S. stocks, ended little changed for the week.

The strikes, which began late Thursday, drove oil prices as high as 11% to the mid-$70 per barrel level, before halving those gains. ExxonMobil, Chevron and ConocoPhillips rallied, while the United States Oil Fund ETF headed for its best percentage gain since April.

LIVE MARKET UPDATES: STOCKS, BONDS, OIL

A view of damaged vehicles in the Iranian capital, Tehran, following an attack. (Fatemeh Bahrami/Anadolu via Getty Images)

OIL & ENERGY

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 112.10 | +2.36 | +2.15% |

| CVX | CHEVRON CORP. | 145.91 | +0.94 | +0.65% |

| COP | CONOCOPHILLIPS | 96.99 | +2.30 | +2.43% |

“This will certainly do some damage to the inflation statistics if it doesn’t roll back soon,” wrote investor Louis Navellier in a note to clients. A report on consumer inflation (CPI) released on Wednesday showed prices remain above the Fed’s 2% target level but still showed some relief.

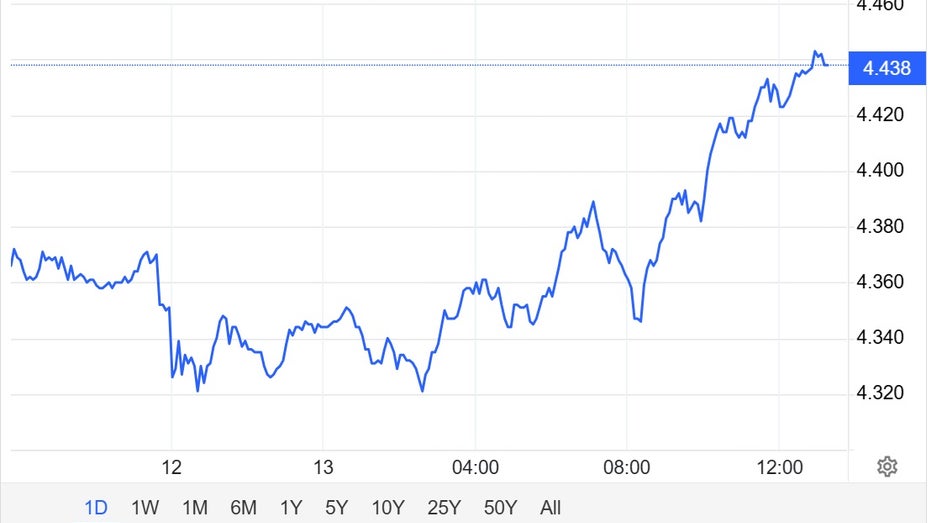

RISING BOND YIELDS

Bond yields, which had been drifting lower, marched higher with the 10-year Treasury back above 4.4%, partly tied to renewed inflation concerns.

“This is a classic flight to safety, and you’re seeing that in Treasury yields,” said Frank Ros, senior market strategist at Angel Oak Capital Advisors, on “Mornings with Maria.” “Today’s investors are concerned with tensions flaring up going into the future,” he noted.

10-Year Treasury yield (TradingEconomics )

GOLD HITS NEW RECORD

Gold hit a fresh record, trading as high as $3,500 an ounce, rallying for the third straight session. The SPDR Gold Trust exchange traded fund, the largest backed by physical gold, is headed for a weekly pop of 3%.

TRUMP DESCRIBES WHEN HIS RELATIONSHIP WITH ELON WENT SOUTH

FED WATCH

The Federal Reserve is not expected to adjust interest rates at next week’s meeting or in July, according to the CME FedWatch Tool, which tracks the probability of rate moves. There is a growing consensus that a rate cut could come in September.

TRUMP NAME CALLS FED CHAIR POWELL

President Donald Trump has publicly needled Federal Reserve Chairman Jerome Powell to cut rates by a full percentage point, calling him a “numbskull” and “Mr. Too Late” for keeping rates at current levels as foreign counterparts, including the European Central Bank, cut rates.

CRYPTOCURRENCY

Bitcoin, the largest cryptocurrency by market value, held at the $105,000 level and is sitting below its all-time high of $111,986.44.

Latest Breaking News Online News Portal

Latest Breaking News Online News Portal